Clay County Mo Car Sales Tax . missouri has a 4.225% sales tax and clay county collects an additional 1.125%, so the minimum sales tax rate in clay county is. If you bought your vehicle. the minimum combined 2024 sales tax rate for clay county, missouri is 5.49%. claycountymo.tax is a joint resource built and maintained by the clay county collector and assessor. use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. This tax rate information is provided as a courtesy to the citizens of clay county. See how to pay tax bills, download. The department collects taxes when an applicant applies for title on a motor. This is the total of state, county, and city sales tax. motor vehicle, trailer, atv and watercraft tax calculator.

from dxoeptjyw.blob.core.windows.net

This tax rate information is provided as a courtesy to the citizens of clay county. missouri has a 4.225% sales tax and clay county collects an additional 1.125%, so the minimum sales tax rate in clay county is. use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. See how to pay tax bills, download. the minimum combined 2024 sales tax rate for clay county, missouri is 5.49%. motor vehicle, trailer, atv and watercraft tax calculator. claycountymo.tax is a joint resource built and maintained by the clay county collector and assessor. If you bought your vehicle. This is the total of state, county, and city sales tax. The department collects taxes when an applicant applies for title on a motor.

Patio Homes Clay County Mo at Angelic Davis blog

Clay County Mo Car Sales Tax If you bought your vehicle. See how to pay tax bills, download. use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. motor vehicle, trailer, atv and watercraft tax calculator. This is the total of state, county, and city sales tax. If you bought your vehicle. This tax rate information is provided as a courtesy to the citizens of clay county. The department collects taxes when an applicant applies for title on a motor. missouri has a 4.225% sales tax and clay county collects an additional 1.125%, so the minimum sales tax rate in clay county is. claycountymo.tax is a joint resource built and maintained by the clay county collector and assessor. the minimum combined 2024 sales tax rate for clay county, missouri is 5.49%.

From www.signnow.com

Mo 1040a 20202024 Form Fill Out and Sign Printable PDF Template Clay County Mo Car Sales Tax use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. If you bought your vehicle. See how to pay tax bills, download. motor vehicle, trailer, atv and watercraft tax calculator. missouri has a 4.225% sales tax and clay county collects an additional 1.125%, so the minimum. Clay County Mo Car Sales Tax.

From mungfali.com

6 Percent Sales Tax Chart Clay County Mo Car Sales Tax This tax rate information is provided as a courtesy to the citizens of clay county. If you bought your vehicle. This is the total of state, county, and city sales tax. claycountymo.tax is a joint resource built and maintained by the clay county collector and assessor. missouri has a 4.225% sales tax and clay county collects an additional. Clay County Mo Car Sales Tax.

From mavink.com

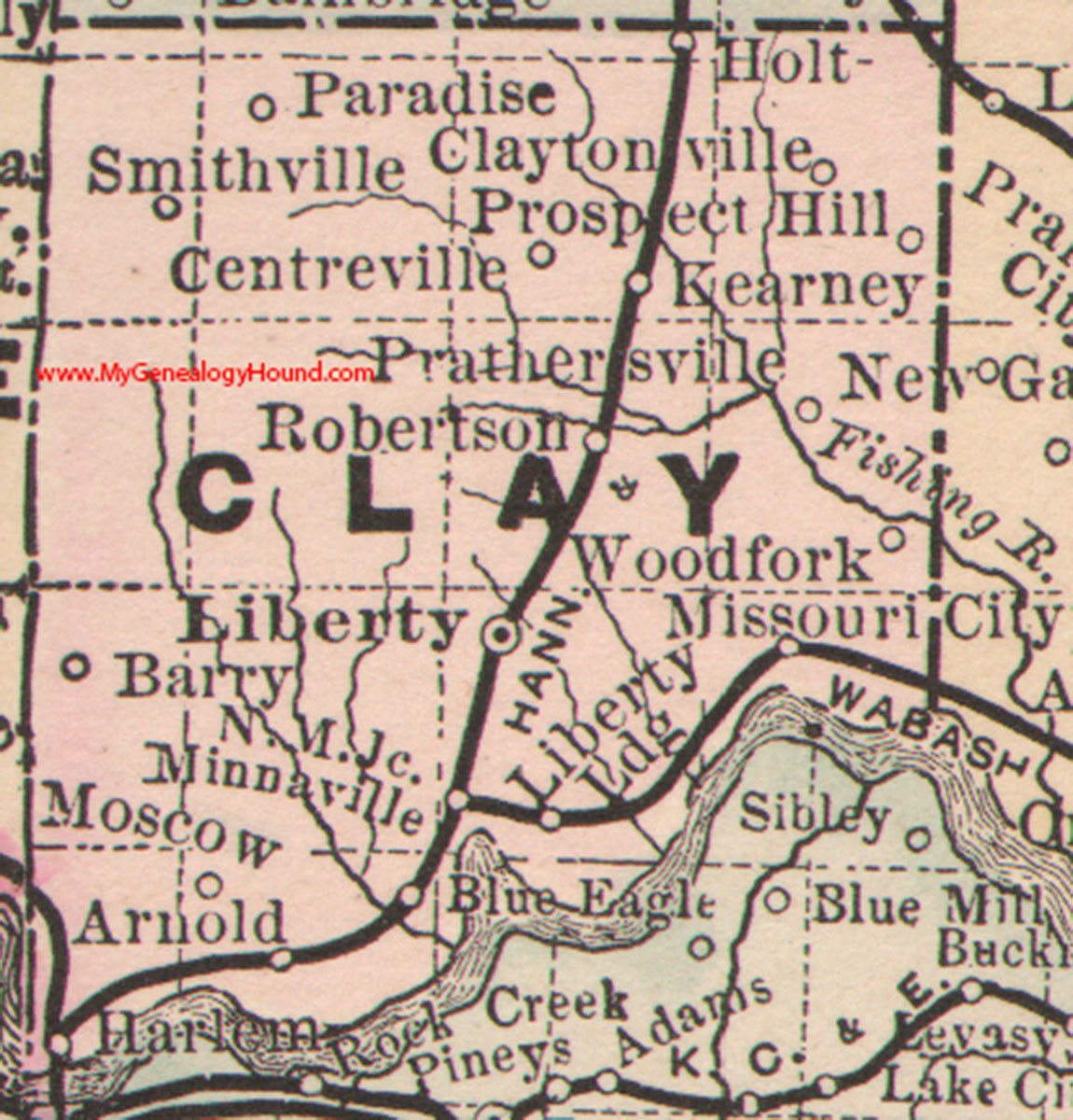

Clay County Map Clay County Mo Car Sales Tax missouri has a 4.225% sales tax and clay county collects an additional 1.125%, so the minimum sales tax rate in clay county is. use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. claycountymo.tax is a joint resource built and maintained by the clay county collector. Clay County Mo Car Sales Tax.

From www.newarkadvocate.com

States with the highest and lowest sales taxes Clay County Mo Car Sales Tax the minimum combined 2024 sales tax rate for clay county, missouri is 5.49%. This is the total of state, county, and city sales tax. The department collects taxes when an applicant applies for title on a motor. This tax rate information is provided as a courtesy to the citizens of clay county. If you bought your vehicle. motor. Clay County Mo Car Sales Tax.

From www.mapsales.com

Clay County, MO Wall Map Color Cast Style by MarketMAPS Clay County Mo Car Sales Tax See how to pay tax bills, download. claycountymo.tax is a joint resource built and maintained by the clay county collector and assessor. The department collects taxes when an applicant applies for title on a motor. motor vehicle, trailer, atv and watercraft tax calculator. This tax rate information is provided as a courtesy to the citizens of clay county.. Clay County Mo Car Sales Tax.

From www.mapsofworld.com

Clay County Map, Missouri Clay County Mo Car Sales Tax claycountymo.tax is a joint resource built and maintained by the clay county collector and assessor. If you bought your vehicle. the minimum combined 2024 sales tax rate for clay county, missouri is 5.49%. See how to pay tax bills, download. motor vehicle, trailer, atv and watercraft tax calculator. This is the total of state, county, and city. Clay County Mo Car Sales Tax.

From anatolawamy.pages.dev

Minnesota Tax Rates 2024 Alix Bernadine Clay County Mo Car Sales Tax The department collects taxes when an applicant applies for title on a motor. use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. This is the total of state, county, and city sales tax. missouri has a 4.225% sales tax and clay county collects an additional 1.125%,. Clay County Mo Car Sales Tax.

From studyimbalzano50.z21.web.core.windows.net

North Carolina Sales Tax Rates 2023 Clay County Mo Car Sales Tax motor vehicle, trailer, atv and watercraft tax calculator. missouri has a 4.225% sales tax and clay county collects an additional 1.125%, so the minimum sales tax rate in clay county is. The department collects taxes when an applicant applies for title on a motor. use the tax calculator to estimate the amount of tax you will pay. Clay County Mo Car Sales Tax.

From www.carsalerental.com

Illinois Car Sales Tax Rate 2014 Car Sale and Rentals Clay County Mo Car Sales Tax If you bought your vehicle. This is the total of state, county, and city sales tax. use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. claycountymo.tax is a joint resource built and maintained by the clay county collector and assessor. motor vehicle, trailer, atv and. Clay County Mo Car Sales Tax.

From dxoeptjyw.blob.core.windows.net

Patio Homes Clay County Mo at Angelic Davis blog Clay County Mo Car Sales Tax This is the total of state, county, and city sales tax. missouri has a 4.225% sales tax and clay county collects an additional 1.125%, so the minimum sales tax rate in clay county is. See how to pay tax bills, download. use the tax calculator to estimate the amount of tax you will pay when you title and. Clay County Mo Car Sales Tax.

From dxoaxnnxc.blob.core.windows.net

Clay County Mo Real Estate Search at Mattie Jessop blog Clay County Mo Car Sales Tax use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. If you bought your vehicle. This tax rate information is provided as a courtesy to the citizens of clay county. missouri has a 4.225% sales tax and clay county collects an additional 1.125%, so the minimum sales. Clay County Mo Car Sales Tax.

From www.mapsales.com

Clay County, MO Wall Map Premium Style by MarketMAPS MapSales Clay County Mo Car Sales Tax This tax rate information is provided as a courtesy to the citizens of clay county. See how to pay tax bills, download. the minimum combined 2024 sales tax rate for clay county, missouri is 5.49%. This is the total of state, county, and city sales tax. missouri has a 4.225% sales tax and clay county collects an additional. Clay County Mo Car Sales Tax.

From www.claycountymo.tax

How to Use the Property Tax Portal Clay County Missouri Tax Clay County Mo Car Sales Tax use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. If you bought your vehicle. See how to pay tax bills, download. claycountymo.tax is a joint resource built and maintained by the clay county collector and assessor. missouri has a 4.225% sales tax and clay county. Clay County Mo Car Sales Tax.

From courtneyscole.com

What’s on the Ballot? Clay and Ray Counties Courtney S. Cole Clay County Mo Car Sales Tax use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle. the minimum combined 2024 sales tax rate for clay county, missouri is 5.49%. missouri has a 4.225% sales tax and clay county collects an additional 1.125%, so the minimum sales tax rate in clay county is.. Clay County Mo Car Sales Tax.

From dxoeptjyw.blob.core.windows.net

Patio Homes Clay County Mo at Angelic Davis blog Clay County Mo Car Sales Tax See how to pay tax bills, download. This tax rate information is provided as a courtesy to the citizens of clay county. claycountymo.tax is a joint resource built and maintained by the clay county collector and assessor. the minimum combined 2024 sales tax rate for clay county, missouri is 5.49%. If you bought your vehicle. motor vehicle,. Clay County Mo Car Sales Tax.

From cewyvtyg.blob.core.windows.net

Clay County Mo Real Estate Tax Search at Day blog Clay County Mo Car Sales Tax missouri has a 4.225% sales tax and clay county collects an additional 1.125%, so the minimum sales tax rate in clay county is. If you bought your vehicle. See how to pay tax bills, download. The department collects taxes when an applicant applies for title on a motor. the minimum combined 2024 sales tax rate for clay county,. Clay County Mo Car Sales Tax.

From mavink.com

Clay County Map Clay County Mo Car Sales Tax This is the total of state, county, and city sales tax. The department collects taxes when an applicant applies for title on a motor. motor vehicle, trailer, atv and watercraft tax calculator. If you bought your vehicle. missouri has a 4.225% sales tax and clay county collects an additional 1.125%, so the minimum sales tax rate in clay. Clay County Mo Car Sales Tax.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Clay County Mo Car Sales Tax missouri has a 4.225% sales tax and clay county collects an additional 1.125%, so the minimum sales tax rate in clay county is. motor vehicle, trailer, atv and watercraft tax calculator. See how to pay tax bills, download. claycountymo.tax is a joint resource built and maintained by the clay county collector and assessor. If you bought your. Clay County Mo Car Sales Tax.